Five lessons that will help you control your decisions when investing your money in the crypto market (NFA)

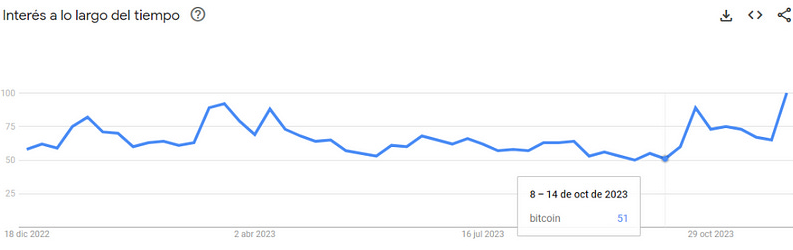

Cryptocurrencies have experienced a significant uptick in recent weeks, resulting in considerable gains for specific projects and attracting people’s attention. That is, they are starting to show renewed interest in the crypto market, as shown in the image below, which offers growth in search interest beginning in October when it moved out of the USD 30,000 range.

If you do not have much technical knowledge about price (identifying trends, prices, volume, candles, etc.), what I think you should consider in this situation is:

- Inform yourself about the economic stage we are in: This means consulting with your trusted people or searching for news that gives you visibility to understand what phase of the market we are in, to know if it is advisable, or if we can wait for better options.

- Know the fundamentals: Why are you buying that crypto? Answer that question, and you will know if you trust the project in the long term.

- Consider the scenarios: Think about what will happen if things don’t go as expected; what would you do in that case? For example, if you buy at 30k and it drops to 25k.

- Don’t be swayed by FOMO: When you see something rise, you consider that it can continue to grow higher, and you enter at high prices, which reduces your capital management capability.

- Define your limits: If you enter at these prices, whether in SPOT or Futures purchase, what are your profit-taking prices? If it doesn’t go as expected, what percentage will you lose to manage your capital adequately?

These recommendations can be helpful for proper risk management and handling of your investments. If you want to know more about it or have any questions or comments, write to me directly or in this post. Remember to share and give me a like to continue writing and helping more people with this content.